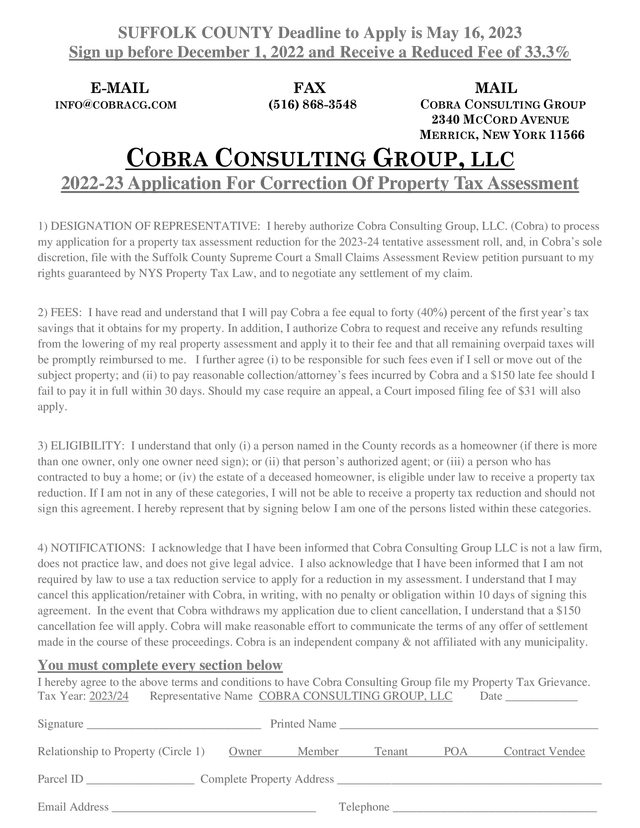

suffolk county tax grievance services

I understand that i am not required by law to use a tax reduction service to apply for a reduction in assessment. I hereby retain Tax Reduction Services TRS as my sole agent.

Property Tax Grievance The Heller Clausen Grievance Group Llc Guide To Reduce Property Taxes In Suffolk County Final Notice Property Tax Grievance The Heller Clausen Grievance Group Llc

Suffolk County Property Tax Reduction Service.

. Grieving Your Property Taxes - An Official Home Appraisal Can Help You Win 2014 Property Tax Grievance in Suffolk County. Our team of expert tax grievance consultants in Suffolk NY are looking forward to working with you towards a lower property tax. At All Island Tax Grievance we specialize in Property Tax Grievance services for Suffolk County Homeowners.

This is mainly due to another mediocre. Tax Reduction Services Inc. File the grievance form with the assessor or the board of.

SUFFOLK COUNTY PROPERTY TAX GRIEVANCE FORM Its simple and fast and our experienced staff will take care of the entire process. The 2023 Suffolk County Tax Grievance season which begins November 1 2022 and ends May 16 2023 is here and it is setting up to be a big one. Years of experience in this field and hundreds of happy.

The Suffolk County grievance deadline is May 17 2022. Thats why we are the only firm that can say we hold the. W e believe that homeowners commercial property owners should pay no more than their fair share of real estate taxes.

Tax Grievance Lawyer Suffolk County. We will get you the REDUCTION YOU DESERVE. Taxation with Great Representation.

If you think youre over-assessed and. In order for us to represent you and reduce your taxes all you have to do is fill out our application here online or. To file a grievance for my owner-occupied 12 or 3 family residence.

When municipalities decide on an estimated value for your. TRS reduces real estate taxes for residential and commercial property owners who live in Nassau and Suffolk Counties. Suffolk County Tax Grievance Cities We Service.

We are exceptionally well-versed in the requirements of Property Tax Grievance. The assessors of each town prepares a tentative assessment roll for that tax. Heller Consultants Tax Grievance specializes in grieving property taxes on Long Island for both Suffolk and Nassau counties saving homeowners thousands.

To reduce your property taxes you have to file a Property Tax Grievance. 2020-2021 Suffolk County Tax Grievance Application. The Suffolk County Property Tax Grievance Process Fill out and send back our retainer agreement to get started.

The tax year for each of the towns in Suffolk County runs from December 1st to the following November 30th. Do you want to pay a LOW FIXED FEE to apply for your property taxes reduction grievance and keep 100 of your savings. TRS is no longer accepting applications for Suffolk County.

You can do this yourself if you love doing paperwork and dealing with Town Hall or you can hire a firm on your behalf. Simply apply below to have us correct your propertys assessment. 80 orville dr ste 100.

Tax Reduction Services Trs Property Tax Grievance

Suffolk County Tax Grievance Form

Long Island Property Tax Grievance Heller Consultants Tax Grievance

Mark Lewis Tax Grievance Service Inc Facebook

Everything You Need To Know About Tax Grievance On Long Island

Suffolk County Tax Grievance Form

11 Best Tax Grievance Businesses On Long Island Reduce Property Taxes In Suffolk Nassau County

Grievance Procedure Town Of Huntington Long Island New York

2018 Property Tax Grievance Town Of Babylon Ny Tax Reduction Suffolk County Ny

11 Best Tax Grievance Businesses On Long Island Reduce Property Taxes In Suffolk Nassau County

The Property Tax Solution Web Design Portfolio All Phase Media

Apply For Property Tax Grievance Zap My Tax

Nassau County Property Tax Grievance Heller Tax Reduction

Long Island Property Tax Grievance Heller Consultants Tax Grievance

New York S Broken Property Assessment Regime City Journal

Suffolk County Tax Grievance Tax Correction Service Llc

The Property Tax Solution Web Design Portfolio All Phase Media